Monte Carlo Simulation Brownian Motion . this article will demonstrate how to simulate brownian motion based asset paths using the python programming language and. — this is a classic building block for monte carlos simulation: — brownian motion. — i built a web app using python flask that allows you to simulate future stock price movements using a method called monte carlo simulations with the choice of two ‘flavours’ : geometric brownian motion for a single asset: — a monte carlo simulation aims to predict future equity values or stock prices over multiple time periods. Brownian motion is a random process used to model a wide variety of physical phenomenon. S t = s 0 exp (r −1 2 σ2)t + σw t w t is n(0,t) random variable, so can put w t.

from people.sc.fsu.edu

Brownian motion is a random process used to model a wide variety of physical phenomenon. S t = s 0 exp (r −1 2 σ2)t + σw t w t is n(0,t) random variable, so can put w t. geometric brownian motion for a single asset: — this is a classic building block for monte carlos simulation: this article will demonstrate how to simulate brownian motion based asset paths using the python programming language and. — a monte carlo simulation aims to predict future equity values or stock prices over multiple time periods. — brownian motion. — i built a web app using python flask that allows you to simulate future stock price movements using a method called monte carlo simulations with the choice of two ‘flavours’ :

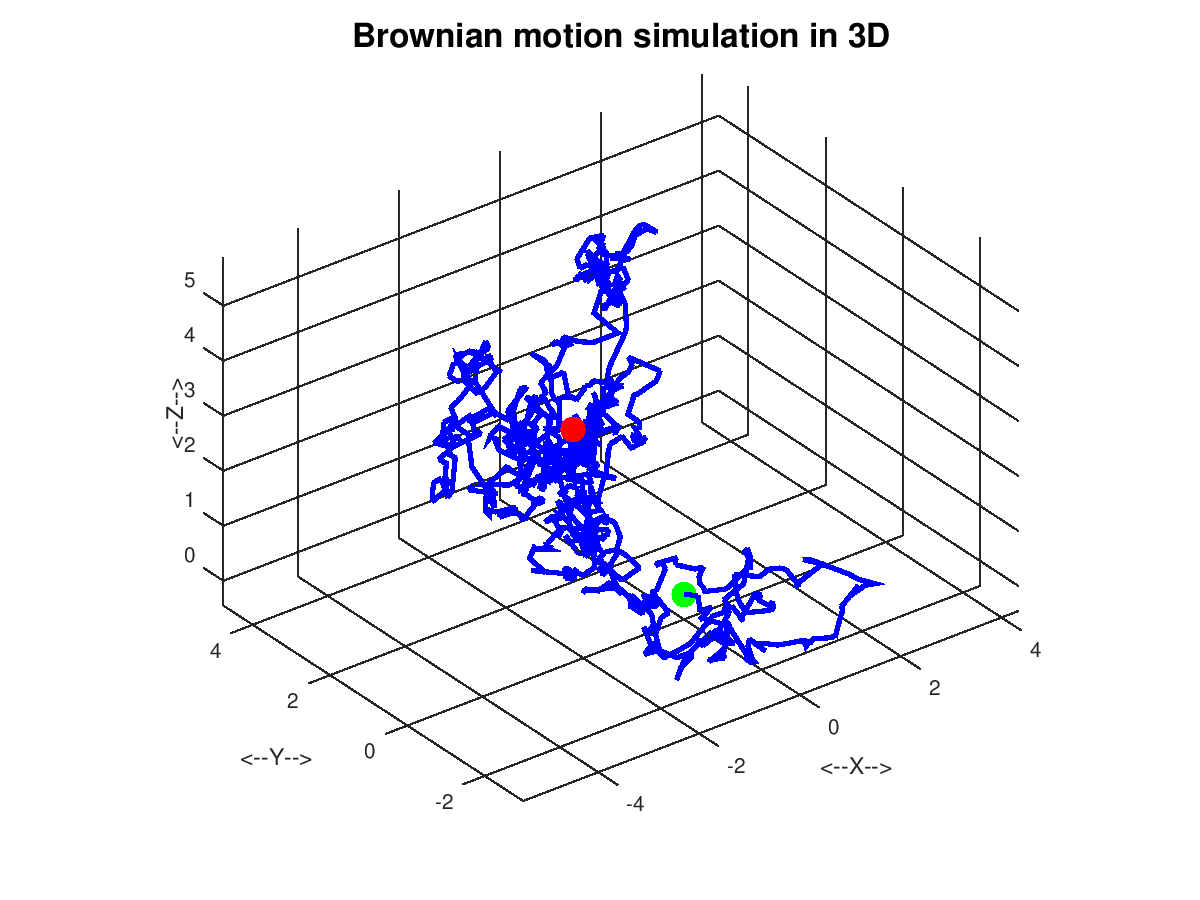

brownian_motion_simulation_test

Monte Carlo Simulation Brownian Motion this article will demonstrate how to simulate brownian motion based asset paths using the python programming language and. — a monte carlo simulation aims to predict future equity values or stock prices over multiple time periods. — brownian motion. this article will demonstrate how to simulate brownian motion based asset paths using the python programming language and. — this is a classic building block for monte carlos simulation: S t = s 0 exp (r −1 2 σ2)t + σw t w t is n(0,t) random variable, so can put w t. Brownian motion is a random process used to model a wide variety of physical phenomenon. — i built a web app using python flask that allows you to simulate future stock price movements using a method called monte carlo simulations with the choice of two ‘flavours’ : geometric brownian motion for a single asset:

From www.intechopen.com

Fractional Brownian Motions in Financial Models and Their Monte Carlo Monte Carlo Simulation Brownian Motion — i built a web app using python flask that allows you to simulate future stock price movements using a method called monte carlo simulations with the choice of two ‘flavours’ : — brownian motion. — this is a classic building block for monte carlos simulation: Brownian motion is a random process used to model a wide. Monte Carlo Simulation Brownian Motion.

From nasyring.github.io

Chapter 4 The geometric Brownian motion model of asset value and Monte Monte Carlo Simulation Brownian Motion — i built a web app using python flask that allows you to simulate future stock price movements using a method called monte carlo simulations with the choice of two ‘flavours’ : — brownian motion. Brownian motion is a random process used to model a wide variety of physical phenomenon. geometric brownian motion for a single asset:. Monte Carlo Simulation Brownian Motion.

From www.semanticscholar.org

[PDF] Fractional Brownian Motions in Financial Models and Their Monte Monte Carlo Simulation Brownian Motion geometric brownian motion for a single asset: — this is a classic building block for monte carlos simulation: — i built a web app using python flask that allows you to simulate future stock price movements using a method called monte carlo simulations with the choice of two ‘flavours’ : Brownian motion is a random process used. Monte Carlo Simulation Brownian Motion.

From towardsdatascience.com

Monte Carlo Simulation in R with focus on Option Pricing by Ojasvin Monte Carlo Simulation Brownian Motion — i built a web app using python flask that allows you to simulate future stock price movements using a method called monte carlo simulations with the choice of two ‘flavours’ : S t = s 0 exp (r −1 2 σ2)t + σw t w t is n(0,t) random variable, so can put w t. this article. Monte Carlo Simulation Brownian Motion.

From www.researchgate.net

Monte CarloBrownian dynamics simulation snapshots, typical Monte Carlo Simulation Brownian Motion S t = s 0 exp (r −1 2 σ2)t + σw t w t is n(0,t) random variable, so can put w t. — brownian motion. this article will demonstrate how to simulate brownian motion based asset paths using the python programming language and. — a monte carlo simulation aims to predict future equity values or. Monte Carlo Simulation Brownian Motion.

From remington-work.blogspot.com

work Simulation of a Geometric Brownian Motion in R Monte Carlo Simulation Brownian Motion S t = s 0 exp (r −1 2 σ2)t + σw t w t is n(0,t) random variable, so can put w t. — this is a classic building block for monte carlos simulation: geometric brownian motion for a single asset: — i built a web app using python flask that allows you to simulate future. Monte Carlo Simulation Brownian Motion.

From www.researchgate.net

Monte Carlo simulations for the geometric Brownian motion (3) for λ Monte Carlo Simulation Brownian Motion — i built a web app using python flask that allows you to simulate future stock price movements using a method called monte carlo simulations with the choice of two ‘flavours’ : S t = s 0 exp (r −1 2 σ2)t + σw t w t is n(0,t) random variable, so can put w t. — brownian. Monte Carlo Simulation Brownian Motion.

From medium.com

Introduction to Monte Carlo Simulation with Geometric Brownian Motion Monte Carlo Simulation Brownian Motion S t = s 0 exp (r −1 2 σ2)t + σw t w t is n(0,t) random variable, so can put w t. this article will demonstrate how to simulate brownian motion based asset paths using the python programming language and. — this is a classic building block for monte carlos simulation: — a monte carlo. Monte Carlo Simulation Brownian Motion.

From file.scirp.org

Brownian Motion of Radioactive Particles Derivation and Monte Carlo Monte Carlo Simulation Brownian Motion Brownian motion is a random process used to model a wide variety of physical phenomenon. — a monte carlo simulation aims to predict future equity values or stock prices over multiple time periods. geometric brownian motion for a single asset: — brownian motion. — i built a web app using python flask that allows you to. Monte Carlo Simulation Brownian Motion.

From towardsdatascience.com

Monte Carlo Simulation in R with focus on Option Pricing by Ojasvin Monte Carlo Simulation Brownian Motion this article will demonstrate how to simulate brownian motion based asset paths using the python programming language and. Brownian motion is a random process used to model a wide variety of physical phenomenon. — a monte carlo simulation aims to predict future equity values or stock prices over multiple time periods. geometric brownian motion for a single. Monte Carlo Simulation Brownian Motion.

From www.youtube.com

Brownian motion simulation YouTube Monte Carlo Simulation Brownian Motion Brownian motion is a random process used to model a wide variety of physical phenomenon. this article will demonstrate how to simulate brownian motion based asset paths using the python programming language and. — this is a classic building block for monte carlos simulation: S t = s 0 exp (r −1 2 σ2)t + σw t w. Monte Carlo Simulation Brownian Motion.

From www.researchgate.net

(PDF) A 3D Monte Carlo Simulation for Aerosol Deposition onto Monte Carlo Simulation Brownian Motion S t = s 0 exp (r −1 2 σ2)t + σw t w t is n(0,t) random variable, so can put w t. — i built a web app using python flask that allows you to simulate future stock price movements using a method called monte carlo simulations with the choice of two ‘flavours’ : — this. Monte Carlo Simulation Brownian Motion.

From www.scribd.com

Monte Carlo Simulation in Java PDF Monte Carlo Method Brownian Motion Monte Carlo Simulation Brownian Motion geometric brownian motion for a single asset: — i built a web app using python flask that allows you to simulate future stock price movements using a method called monte carlo simulations with the choice of two ‘flavours’ : Brownian motion is a random process used to model a wide variety of physical phenomenon. S t = s. Monte Carlo Simulation Brownian Motion.

From interestingfactsworld.com

3+ Legendary Brownian Motion Facts You Need to Know for School Monte Carlo Simulation Brownian Motion Brownian motion is a random process used to model a wide variety of physical phenomenon. this article will demonstrate how to simulate brownian motion based asset paths using the python programming language and. — a monte carlo simulation aims to predict future equity values or stock prices over multiple time periods. — brownian motion. — this. Monte Carlo Simulation Brownian Motion.

From www.youtube.com

Brownian Motion Simulation Java YouTube Monte Carlo Simulation Brownian Motion — a monte carlo simulation aims to predict future equity values or stock prices over multiple time periods. — brownian motion. this article will demonstrate how to simulate brownian motion based asset paths using the python programming language and. — i built a web app using python flask that allows you to simulate future stock price. Monte Carlo Simulation Brownian Motion.

From www.youtube.com

Portfolio Evaluation using Monte Carlo Simulation of Brownian Motion Monte Carlo Simulation Brownian Motion Brownian motion is a random process used to model a wide variety of physical phenomenon. — brownian motion. — a monte carlo simulation aims to predict future equity values or stock prices over multiple time periods. this article will demonstrate how to simulate brownian motion based asset paths using the python programming language and. geometric brownian. Monte Carlo Simulation Brownian Motion.

From github.com

MonteCarlosimulationofGeometricBrownianMotionwithapplications Monte Carlo Simulation Brownian Motion — a monte carlo simulation aims to predict future equity values or stock prices over multiple time periods. — this is a classic building block for monte carlos simulation: this article will demonstrate how to simulate brownian motion based asset paths using the python programming language and. Brownian motion is a random process used to model a. Monte Carlo Simulation Brownian Motion.

From www.researchgate.net

Onedimensional fractional Brownian motion (FBM) trajectories We show Monte Carlo Simulation Brownian Motion — i built a web app using python flask that allows you to simulate future stock price movements using a method called monte carlo simulations with the choice of two ‘flavours’ : — this is a classic building block for monte carlos simulation: S t = s 0 exp (r −1 2 σ2)t + σw t w t. Monte Carlo Simulation Brownian Motion.